About the Course

The British Professional College, a sister organisation of The British College Kathmandu, is one of the few PLATINUM Status Approved Learning Partners to provide the ACCA (Association of Chartered Certified Accountants) in Nepal.

The ACCA qualification is designed to teach students the accounting knowledge, skills, and professional values needed to build a successful career across any sector. This global body for professional accountants is the ideal study route for students who are looking to pursue a rewarding career in accountancy, management, or finance, and opens doors to interesting roles all over the world.

Please click here to visit the ACCA Global Website for details.

Why Study ACCA at British Professional College?

Faculty

At The British Professional College, our esteemed faculty comprises highly qualified educators and seasoned tutors specialising in ACCA, including FCAs and FCCAs, bringing a wealth of expertise and experience to our academic team.

“We believe the best faculty members are the assets and guiding tools for any student to go through exams.”

Head of Professional Education: Dipendra K Shrestha

Admissions Details

Course Intake: March/ June/ September/ December

Course Duration: The ACCA qualification exams take 3 years (approx.) to complete.

Requirements to Qualify as an ACCA Member

- Complete 13 exams (nine are eligible for exemptions).

- Gain three years of practical experience.

- Complete the online Ethics and Professional Skills module.

ACCA Approved Employer

The British College proudly holds ACCA Approved Employer status with the prestigious Platinum designation for Trainee Development – the highest tier of recognition specifically for student training excellence within ACCA's global employer approval programme.

While we maintain ACCA Approved Employer status, which recognises our high standards of staff training and development, our Platinum Trainee Development designation represents something truly exceptional – elite-level recognition for our world-class approach to nurturing the next generation of accounting and finance professionals.

This prestigious Platinum recognition for trainee development is awarded exclusively to institutions that demonstrate student support, training excellence, and professional growth opportunities that go far beyond industry standards.

What this means for our students:

- Access to premium study support with dedicated ACCA-qualified mentors.

- Advanced study resources and materials designed for trainee success

- Enhanced employability – graduates are recognised by top employers worldwide

- Global recognition of the qualification and training standards

What this means for our ACCA members (employees):

- CPD requirements covered by our high-quality professional development programmes

- Comprehensive career progression support and training opportunities

- Recognition as part of an elite institution, enhancing professional credibility

- Access to cutting-edge professional development resources and programmes

Licensed Computer Based Exam (CBE) Centre

About On-Demand CBE

The British College is an approved Testing Centre for ACCA Computer-Based Exams (CBEs). CBEs are available for BT, MA, FA, LW and FIA papers. CBEs offer flexibility as they can be set at any time and you are not restricted to four ACCA exam sessions.

OBU BSc Mentorship Service

The BSc (Hons) Degree in Applied Accounting from Oxford Brookes University is available to ACCA students for a limited time only. This provides an opportunity for students to obtain a degree while studying towards the ACCA Qualification.

The opportunity to complete the BSc (Hons) in Applied Accounting will close in May 2026.

Completing this degree offers numerous advantages, primarily the potent synergy of a degree and a professional accounting qualification. This powerful combination enhances employability and significantly boosts career prospects. But don't solely take our word for it—experience the benefits firsthand.

Mentorship services for Oxford Brookes University's BSc (Hons) Degree in Applied Accounting project are now available through the British Professional College for the November 2025 and May 2026 submission periods. Limited seats are available!

Register here to reserve your seat to get mentorship service.

Only our Trade Tower, Thapathali, Kathmandu campus holds Platinum ALP status.

Applied Knowledge Level /FIA :

- 10+2/SEE (A-C) (in five separate subjects including Mathematics & English)

- + 2 passes at GCE / VCE A-Level (grades A-E)

Applied Skills Level :

- FIA/ACCA Applied Knowledge level papers passed or exempted

Strategic Professional Level :

- ACCA Applied Knowledge and Applied Skills level papers passed or exempted

English:

- IELTS Requirement: Minimum 6.0 or equivalent (with at least 5.5 in each band)

Students who do not have any formal qualifications or do not meet the minimum entry requirements will need to complete:

- 3 exams – Foundations in Business and Technology (FBT), Management Accounting (FMA) and Financial Accounting (FFA)

- A professionalism and ethics module called Foundations in Professionalism is also part of completing a Foundation in Accountancy qualification. Once completed, they are eligible to enter directly to the ACCA programme and receive exemptions for the first 3 knowledge modules.

Your Future

Upon completion of the ACCA qualification, students are qualified to work in any sector, both nationally and internationally, in a number of roles including (but not limited to):

- Auditing

- Tax Consulting

- Financial Control

- Management Accountancy

- Treasury Consultancy

- Business Analysis

- Entrepreneurship

ACCA Papers

| APPLIED KNOWLEDGE | |

| Business and Technology (BT) | |

| Management Accounting (MA) | |

| Financial Accounting (FA) | |

| APPLIED SKILLS | |

| Corporate and Business Law (LW) | |

| Performance Management (PM) | |

| Taxation (TX) | |

| Financial Reporting (FR) | |

| Audit and Assurance (AA) | |

| Financial Management (FM) |

Strategic Professional

| ESSENTIALS | |

| Strategic Business Leader (SBL) | |

| Strategic Business Reporting (SBR) | |

| OPTIONS (ANY TWO) | |

| Advanced Financial Management (AFM) | |

| Advanced Performance Management (APM) | |

| Advanced Taxation (ATX) | |

| Advanced Audit and Assurance (AAA) | |

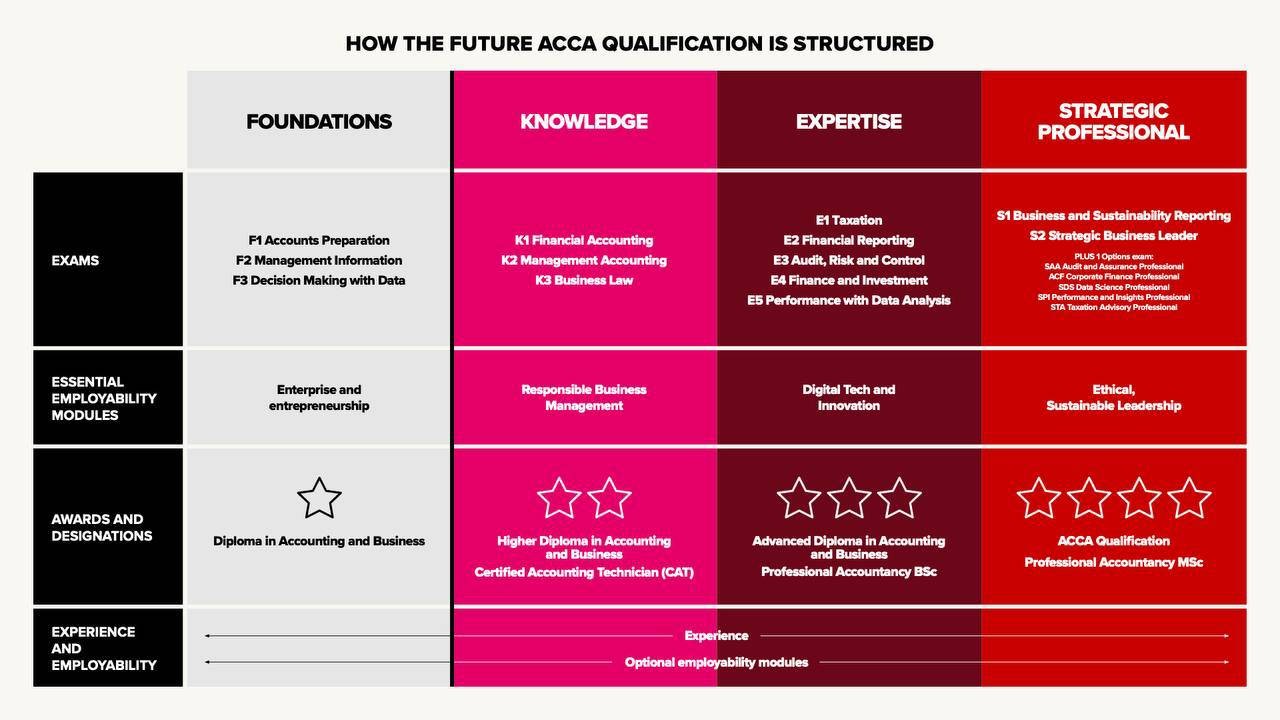

Upcoming Changes in the ACCA Programme

The future of finance demands agility, innovation, and strategic thinking. That’s why ACCA has reimagined the Qualification—equipping the next generation of finance professionals with the skills employers need. Changes take place from July 2027.

_2.png)

_2.png)

_2.png)